In recent years, many travel agents have gone independent and taken the leap into self-employment. Like the self-employed in any sector, going freelance requires a lot of commitment, including long hours, a high level of industry knowledge and a certain amount of risk.

In recent years, many travel agents have gone independent and taken the leap into self-employment. Like the self-employed in any sector, going freelance requires a lot of commitment, including long hours, a high level of industry knowledge and a certain amount of risk.

On the plus side, your independence allows you to work from anywhere you please and be your own boss, with any significant successes and profits you earn yours alone.

However, when a full time employee goes into self-employment, their outgoing costs continue as normal, but their incomings can become unstable. Companies like Boox are there to keep things steady during these periods of uncertainty, by providing a fast and simple service for freelancers to set up and run a tax-efficient business.

The easy-to-use service allows self-employed travel agents to focus on other parts of their businesses and their lives, rather than spending hours worrying about the tax man each month. It combines the benefits of a cloud-based portal with unlimited access to a personal accountant, who can make balancing your books more transparent and removes much of the hassle often associated with contending against an automated system.

?

Setting up

Boox can guarantee the complete setup of a limited company within four hours of initiation (or if the company formation request comes in after 13:00, then the next morning). If you don?t already have a business bank account, then Boox can help you set one up. Boox prides itself on its speed and efficiency, and this is in evidence throughout the service ? after incorporation, they understand that the quicker the business can get invoicing, the quicker it can be paid.

?

Features

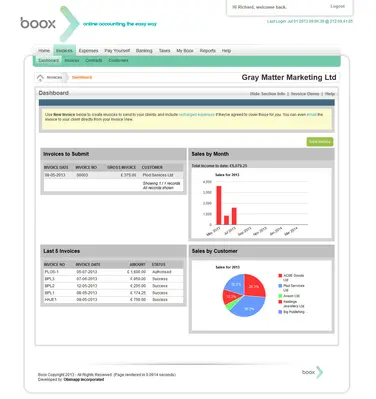

The portal is divided across eight sections, which includes Invoices, Expenses, Banking, Taxes, Pay Yourself and Reports. Each section has a top-level dashboard, which below includes wider functions and reporting. The My Boox section will allow you to contact your personal accountant or amend your company?s details. Each section is self-explanatory and users have the Help section if you run into any issues, which is packed with useful articles. However, most features are fairly easy to work out even for those totally unfamiliar with accounting administration.

The dashboards use charts to explain relevant data, which is presented alongside tables that list other important data such as expenses. The Home dashboard shows graphical representations of monthly sales, expenses, and sales-minus-expenses (profit), so you can see exactly how you?re doing each month with a single glance. Helpfully, it also shows tax liabilities for VAT, PAYE/NIC and other important administrative figures.

?

Efficiency

Raising invoices and expenses is straightforward, and there is even a ?quick invoice/expense? function if you need to just drop in and out. Users also have control over the way invoices are generated and numbered, and there is a ?Favourites? section that allows you to favourite and clone invoices if you have repeat clients, removing another layer of complication.??

In addition, your own personal accountant makes time-consuming bank account management straightforward, as your statements are reconciled automatically with your business.

All in all the service offers an uncomplicated way for self-employed travel agents to? manage their businesses finances and taxes. The online portal itself is accessible from any internet-connected computer, and it is intuitive and easy-to-use enough for any self-employed individual to find useful. It is available from ?69.50 plus VAT per month, which includes 24-hour access to the online accounting portal, and a dedicated personal accountant. There is also a 14-day free trial available from www.boox.co.uk, to test the service for yourself before you commit.